|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

dzhb5hnvz Best Mortgage CRM: Navigating Your Options for Optimal EfficiencyChoosing the best mortgage CRM can be daunting, but understanding your options can lead to significant efficiency improvements. The right CRM system not only streamlines operations but also enhances customer relationships. Understanding Mortgage CRM EssentialsA mortgage CRM is tailored to meet the specific needs of mortgage professionals. It helps manage client information, automate tasks, and maintain strong client relationships. Core Features to Consider

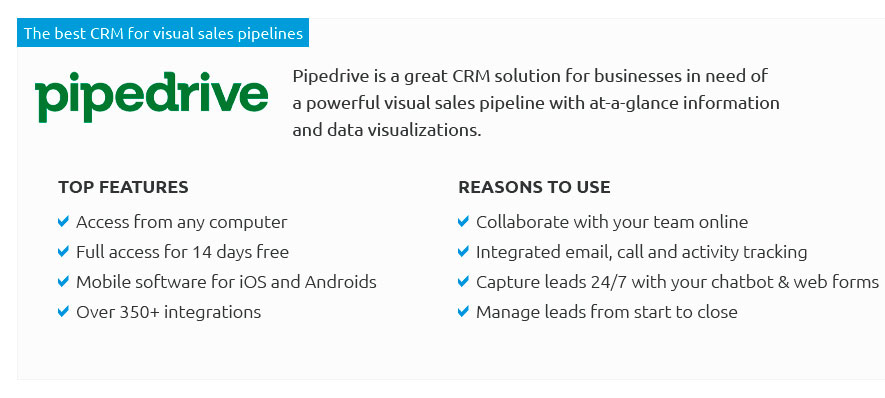

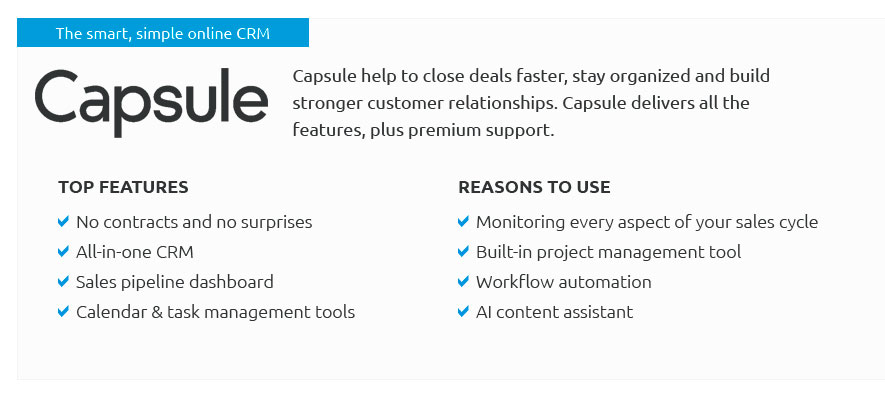

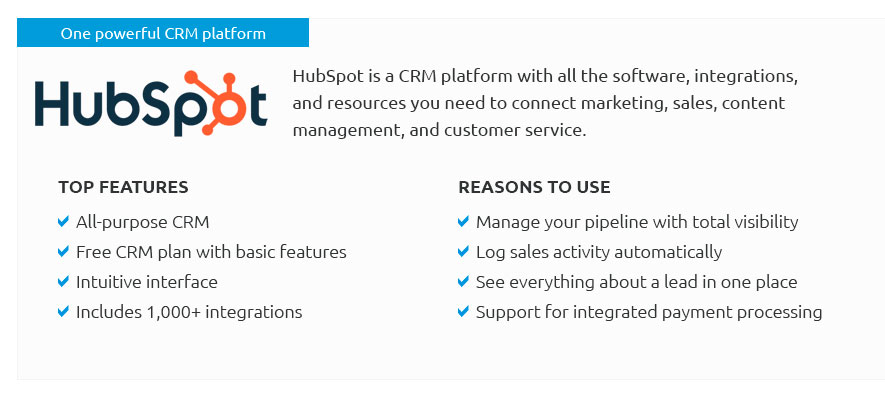

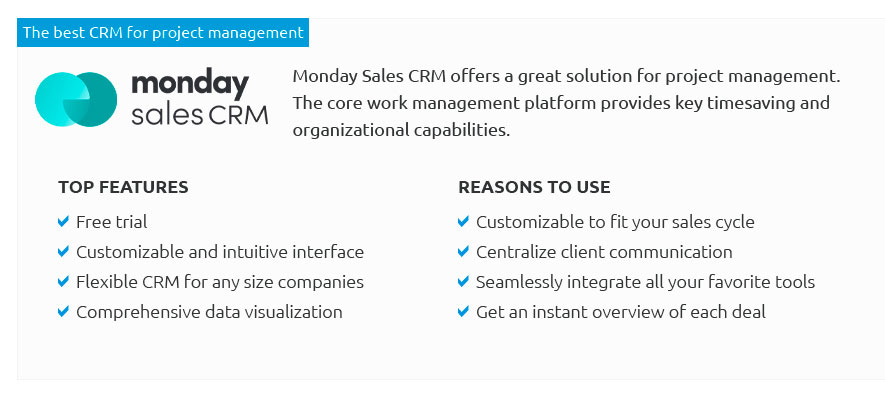

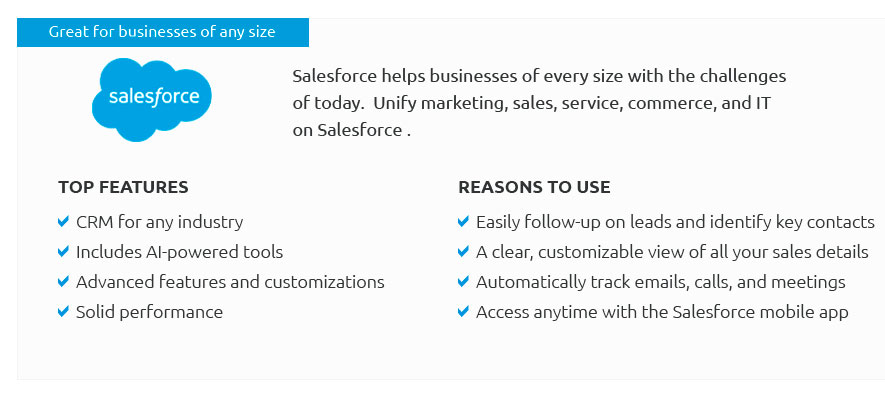

By focusing on these core features, mortgage professionals can better serve their clients and improve their business operations. Top Picks for Mortgage CRMsWhile many options exist, selecting a CRM that aligns with your business needs is crucial. Here are some top contenders: Popular CRM Choices

Each CRM offers unique strengths, so evaluating them in the context of your specific needs is essential. For a detailed comparison, you can explore crm software review. Integrating CRM into Your WorkflowIntegration is key to maximizing the benefits of your CRM system. It should seamlessly fit into your existing workflow, enhancing rather than disrupting operations. Steps to Successful Integration

Proper integration ensures that your CRM system provides the greatest possible value. For more on integrating CRM effectively, you can use crm as a resource. FAQWhat is a mortgage CRM?A mortgage CRM is a customer relationship management tool designed specifically for mortgage professionals, helping them manage client interactions, automate processes, and enhance customer service. How does a mortgage CRM benefit my business?A mortgage CRM can streamline operations, improve customer interactions, automate routine tasks, and provide analytics for informed decision-making, ultimately increasing efficiency and client satisfaction. What features should I look for in a mortgage CRM?Key features to consider include contact management, automation, integration capabilities, and robust analytics to ensure the CRM meets your specific business needs. https://www.youtube.com/watch?v=D1rG4YSn0i0

aipowered #loanofficer #campaign #mortgage #crm #realestate Best AI-Powered Mortgage CRM for Loan Officers | Proven Campaigns & Automated ... https://monday.com/blog/crm-and-sales/mortgage-crm/

A mortgage customer relationship management (CRM) platform helps organizations keep track of all the leads and borrowers in their pipeline. https://www.youtube.com/watch?v=iSbEhQ4LF_s

Best AI-Powered Mortgage CRM for Loan Officers | Proven Campaigns & Automated Workflows. Mortgage Marketing With Chris Johnstone

|